Returning to the “PP&E, net” line item, the formula is the prior year’s PP&E balance, less Capex, and less depreciation. Once repeated for all five years, the “Total Depreciation” line item sums up the depreciation amount for the current year and all previous periods to date. The depreciation expense comes out to $60k per year, depreciation waterfall which will remain constant until the salvage value reaches zero. In a full depreciation schedule, the depreciation for old PP&E and new PP&E would need to be separated and added together. Capex as a percentage of revenue is 3.0% in 2021 and will subsequently decrease by 0.1% each year as the company continues to mature and growth decreases. For mature businesses experiencing low, stagnating, or declining growth, the depreciation to capex ratio converges near 100%, as the majority of total Capex is related to maintenance Capex.

The two main assumptions built into the depreciation amount are the expected useful life and the salvage value. This Depreciation Schedule template provides a simple method for calculating total yearly depreciation for multiple assets. From our modeling tutorial, our hypothetical scenario shows the method by which depreciation, PP&E, and Capex can be forecasted, and illustrates just how intertwined the three metrics ultimately are. Then, we can extend this formula and methodology for the remainder of the forecast. For 2022, the new Capex is $307k, which after dividing by 5 years, comes out to be about $61k in annual depreciation.

Companies seldom report depreciation as a separate expense on their income statement. Thus, the cash flow statement (CFS) or footnotes section are recommended financial filings to obtain the precise value of a company’s depreciation expense. Conceptually, the depreciation expense in accounting refers to the gradual reduction in the recorded value of a fixed asset on the balance sheet from “wear and tear” with time. You’ll often encounter catch-all line items on the balance sheet simply labeled “other.” Sometimes the company will provide disclosures in the footnotes about what’s included, but other times it won’t.

Practice while you learn with exercise files

The units of production method recognizes depreciation based on the perceived usage (“wear and tear”) of the fixed asset (PP&E). For example, if a company buys back $100 million of its own shares, treasury stock (a contra account) declines (is debited) by $100 million, with a corresponding decline (credit) to cash. Note that DTAs and DTLs can be classified in the financial statements as both current and non-current. The U.S. MACRS System is highly regulated and adds quite a bit of complexity to the simple depreciation formulas. You should consult IRS Publication 946 to determine how to depreciate your property for tax purposes. The screenshot above is an example of a 5-year straight-line depreciation, from CFI’s e-commerce financial modeling course.

What is a Depreciation Schedule?

It is a key forecast in an integrated 3-statement financial model, and we can only quantify the amount of short term funding required after we forecast the cash flow statement. That’s because cash and short term debt (the revolver) serve as a plug in most 3-statement financial models – if after everything else is accounted for, the model is forecasting a cash deficit, the revolver will grow to fund the deficit. Conversely, if the model is showing a cash surplus, the cash balance will simply grow.

How Depreciation Works in Accounting

- Suppose that trailer technology has changed significantly over the past three years and the company wants to upgrade its trailer to the improved version while selling its old one.

- There are various depreciation methodologies, but the two most common types are straight-line depreciation and accelerated depreciation.

- The depreciation expense reduces the carrying value of a fixed asset (PP&E) recorded on a company’s balance sheet based on its useful life and salvage value assumption.

- The units of production method recognizes depreciation based on the perceived usage (“wear and tear”) of the fixed asset (PP&E).

- That boosts income by $1,000 while making the balance sheet stronger by the same amount each year.

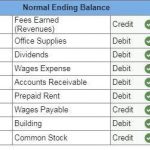

Instead, the cost is placed as an asset onto the balance sheet and that value is steadily reduced over the useful life of the asset. This happens because of the matching principle from GAAP, which says expenses are recorded in the same accounting period as the revenue that is earned as a result of those expenses. In terms of forecasting depreciation in financial modeling, the “quick and dirty” method to project capital expenditures (Capex) and depreciation are the following. Depreciation is a non-cash expense that allocates the purchase of fixed assets, or capital expenditures (Capex), over its estimated useful life. Retained earnings is the link between the balance sheet and the income statement.

The third scenario arises if the company finds an eager buyer willing to pay $80,000 for the old trailer. As you might expect, the same two balance sheet changes occur, but this time, a gain of $7,000 is recorded on the income statement to represent the difference between the book and market values. The above example uses the straight-line method of depreciation and not an accelerated depreciation method, which records a larger depreciation expense during the earlier years and a smaller expense in later years. The formula to calculate the annual depreciation is the remaining book value of the fixed asset recorded on the balance sheet divided by the useful life assumption. On the balance sheet, depreciation expense reduces the book value of a company’s property, plant and equipment (PP&E) over its estimated useful life. The depreciation expense, despite being a non-cash item, will be recognized and embedded within either the cost of goods sold (COGS) or the operating expenses line on the income statement.

Son Yorumlar