On the debit side, a firm can record any cash that it has at the beginning of the month or any income it receives. Small businesses often use this type of cash book to record and track cash inflow and outflow. Cash Book contains cash transactions passing into and out of business. 2 types of Cash Book are (1) general cash book and (2) petty cash book. The general cash book is subdivided into the single column, double column, and treble column cash book. Debit and Credit and columns of Date, Particulars, Journal Folio, and Amount on each side.

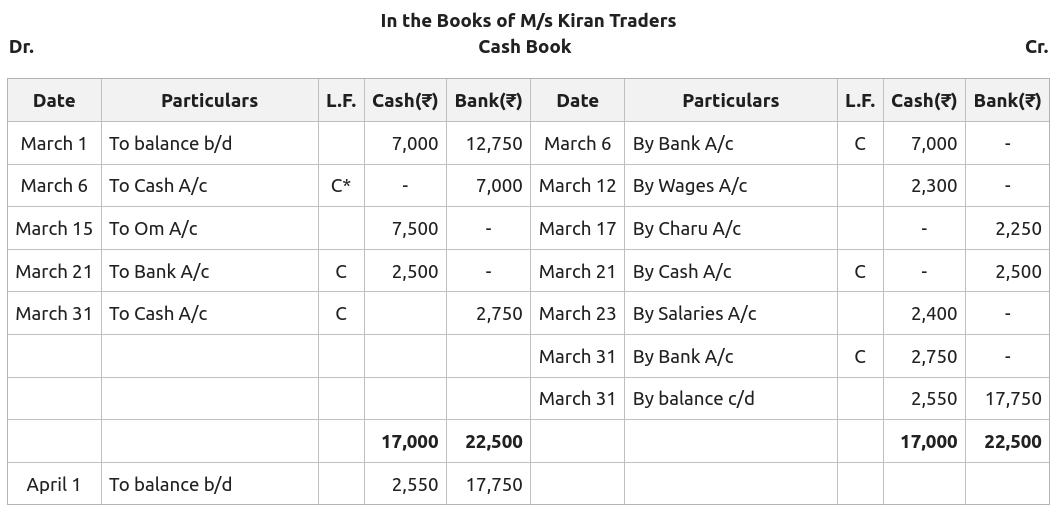

Format

One of the famous principles of management is ‘control by exception’ which means that if one person tries to control everything, he may end up controlling nothing. Based on this principle, a petty cashier is appointed who can control the irregular expenses. In the absence of petty cashier, it is very difficult to watch and control the necessities of incurring any expenses. By putting the difference under the amount column both sides of the cash book become equal.

Two Column Cash Books

You may remember that cash and discounts are closely related. This is the reason why discount columns are also provided in the cash book. Now total amount under the ‘Amount’ columns on both side of the cash book is written opposite to each other.

Sample Format of Two Column Cash Book

- This type of cash book is used by businesses who want to track each individual transaction in more detail.

- A bank cheque book is a booklet containing multiple blank cheques issued by a bank.

- Understanding how that process works with a cash book can help business owners ensure the accuracy of cash transactions.

- In case a transaction affects both the cash and the bank account, a contra entry is recorded.

Despite being difficult to maintain on a large scale, organizations ensure maintaining cash book accounting for a handful of reasons. This voucher must be authorized by a responsible officer before the petty cashier makes the payment. When a payment needs to be made from the petty cash fund, the petty cashier prepares a petty cash voucher (PCV).

It does not record the transaction-related, which involves banks or discounts. The transactions done on credit are not recorded while preparing the single-column cash–book. In order for a cash book to be accurate and up-to-date, it is important to record all transactions as soon as they happen. If money is received on Monday, but not recorded until Wednesday, the cash book will be inaccurate.

What are the advantages of a three column cash book?

Thus maintaining triple column cash book substitutes, cash account, bank account, and discount accounts. The easiest and simplest cash book meaning is a book that records every cash transaction of the business. A cash book is one of the most important journals among the books of accounts. It easily lets people know the net cash-outflow or inflow of a financial year. All payments and receipts are recorded in chronological order, so it becomes convenient to trace a transaction on a particular date. The organisation, which has to make many transactions, maintains a cash book in two parts, a cash receipt journal and a cash disbursement journal.

As the name implies, there are two columns for this type of cash book. It allows users to keep more detailed notes about their transactions. The single-column cash book is the easiest type of cash book to use. This type is commonly used by individuals who want to keep track of their own money and finances.

The total amount column is followed by number of columns for recording the heads of items which are most common in the business enterprise. Again, the three column cash ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit). The two column cash ledger book is sometimes referred to as the double column cash book or the 2 column cash book. Again, for simplicity, tax bracket definition the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit). Again, for simplicity, the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit) . It acts as a journal or book of prime entry because all cash transactions are recorded in it as and when they take place.

Bir Yorum Yazın