With increases in a company’s estimated profitability, expected growth, and safety of its business, the market value per share grows higher. Significant differences between the book value per share and the market value per share arise due to the ways in which accounting principles classify certain transactions. Book value per share (BVPS) measures the book value of a firm on a per-share basis. BVPS is found by dividing equity available to common shareholders by the number of outstanding shares.

Book Value Per Common Share (BVPS): Definition and Calculation

- Therefore, book value is roughly equal to the amount stockholders would receive if they decided to liquidate the company.

- Sometimes, companies get equity capital through other measures, such as follow-on issues, rights issues, and additional share sales.

- The value of a common stock, therefore, is related to the monetary value of the common shareholders’ residual claim on the corporation – the net asset value or common equity of the corporation.

- BVPS offers a baseline, especially valuable for value investors looking for opportunities in underpriced stocks.

- However, you would need to do some more research before making a final decision.

Oddly enough, this has been a constant refrain heard since the 1950s, yet value investors continue to find book value plays. Failing bankruptcy, other investors would ideally see that the book value was worth more than the stock and also buy in, pushing the price up to match the book value. The term “book value” is derived from accounting lingo, where the accounting journal and ledger are known as a company’s books. The following image shows Coca-Cola’s “Equity Attributable to Shareowners” line at the bottom of its Shareowners’ Equity section.

Example of BVPS

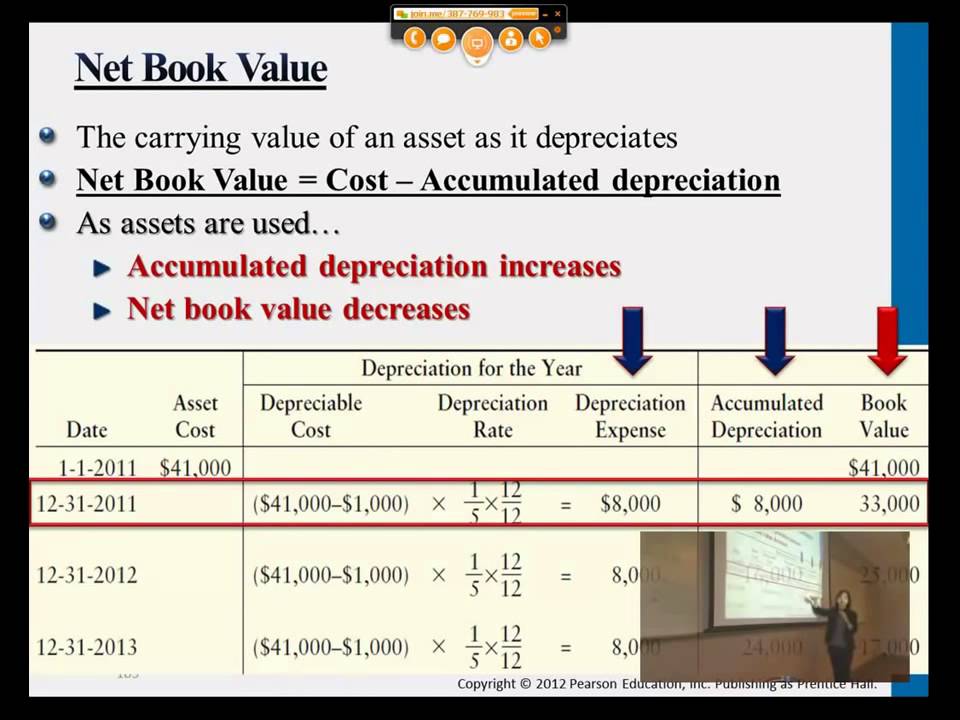

As the market price of shares changes throughout the day, the market cap of a company does so as well. On the other hand, the number of shares outstanding almost always remains the same. contra asset account Therefore, market value changes nearly always occur because of per-share price changes. Some of these adjustments, such as depreciation, may not be easy to understand and assess.

Book Value Per Share: Definition, Formula & Example

That’s important to keep in mind when analyzing a company’s book value because it is partially defined by asset-carrying values. There are a number of other factors that you need to take into account when considering an investment. For example, the company’s financial statements, competitive landscape, and management team. You also need to make sure that you have a clear understanding of the risks involved with any potential investment. Preferred stock is usually excluded from the calculation because preferred stockholders have a higher claim on assets in case of liquidation. By repurchasing 1,000,000 common shares from the company’s shareholders, the BVPS increased from $3.00 to $4.50.

Is BVPS relevant for all types of companies?

Investors commonly analyze book value in the context of the company’s market value. The relationship between the two quantifies the premium that investors are paying (or not) to own that stock. There are other factors that you need to take into consideration before making an investment. However, book value per share can be a useful metric to keep in mind when you’re analyzing potential investments. BVPS is more relevant for asset-heavy companies, such as manufacturing firms, where physical assets constitute a significant portion of the balance sheet.

Minority interest is the ownership of less than 50 percent of a subsidiary’s equity by an investor or a company other than the parent company. Investors can find a company’s financial information in quarterly and annual reports on its investor relations page. However, it is often easier to get the information by going to a ticker, such as AAPL, and scrolling down to the fundamental data section. If a company is selling 15% below book value, but it takes several years for the price to catch up, then you might have been better off with a 5% bond. InvestingPro offers detailed insights into companies’ Book Value Per Share including sector benchmarks and competitor analysis.

In this case, the stock seems to trade at a multiple that is roughly in line with its peers. Even though book value per share isn’t perfect, it’s still a useful metric to keep in mind when you’re analyzing potential investments. Critics of book value are quick to point out that finding genuine book value plays has become difficult in the heavily-analyzed U.S. stock market.

That leads to a book valuation of $206.22 billion ($411.97 billion – $205.75 billion). Book value per share relates to shareholders’ equity divided by the number of common shares. Earnings per share would be the net income that common shareholders would receive per share (company’s net profits divided by outstanding common shares). The figure that represents book value is the sum of all of the line item amounts in the shareholders’ equity section on a company’s balance sheet. As noted above, another way to calculate book value is to subtract a business’ total liabilities from its total assets.

Bir Yorum Yazın