Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The best way to understand the realization principle is through the following examples.

Is there any other context you can provide?

It basically is one of the golden rules of accounting – for every credit, there must be a corresponding debit. So every transaction we record must have a two-fold effect, i.e. it will be recorded in two places. Performance indicates the seller has fulfilled a majority of their expectations in order to get payment. Measurability, on the other hand, relates to the matching principle wherein the seller can match the expenses with the money earned from the transaction.

How Liam Passed His CPA Exams by Tweaking His Study Process

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Revenue recognition dictates when and how a company should record its revenue on its financial statements.

- For example, revenue is realized when goods are delivered to customers, not when the contract is signed to deliver the goods.

- By adhering to this principle, companies can provide a more accurate picture of their financial performance, which is invaluable for investors, creditors, and other stakeholders.

- The Realization Principle is a fundamental accounting principle that outlines when revenue should be recognized in the financial statements.

- Contracts that span over a long period can be difficult to manage and calculate revenue realization accurately.

- Companies also frequently tailor their pricing, sales, and marketing strategies based on the information found in their financial reports.

GAAP Revenue Recognition Principles

This principle states that revenue should be recognized when it is realized or realizable and earned. This means that revenue is recorded only when there is a high degree of certainty that it will be received, and the earnings process is substantially complete. This approach helps in preventing the premature recognition of revenue, which can distort financial statements and mislead stakeholders. Accrual accounting also incorporates the matchingprinciple (otherwise known as the expense recognitionprinciple), which instructs companies to record expenses related torevenue generation in the period in which they are incurred. Theprinciple also requires that any expense not directly related torevenues be reported in an appropriate manner. Theprinciple has determined that costs cannot effectively be allocatedbased on an individual month’s sales; instead, it treats theexpense as a period cost.

Which of these is most important for your financial advisor to have?

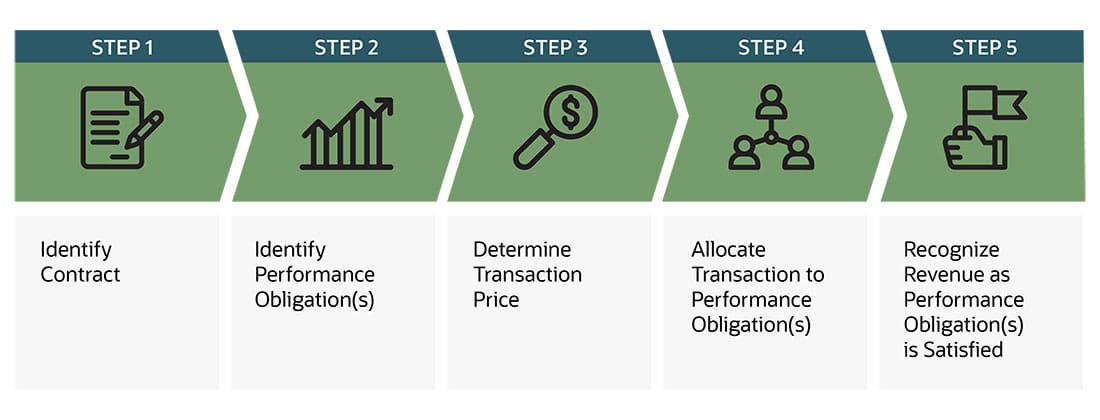

Despite all the potential complexities, businesses must recognize revenue according to established industry standards to stay legally compliant and report their financials accurately and transparently. Performed correctly, revenue recognition follows several generally accepted accounting principles (GAAP) that we will discuss in more detail below. Keep reading to learn about the implications of revenue recognition, how to handle common pitfalls when recording revenue, and which GAAP guidelines pertain to revenue recognition. If the goods or services were transferred on or before the date of invoice, then the sale can be considered complete and the revenue can be recorded. However, if the transfer takes place after the invoice date, then the sale is considered pending and the revenue should not be recognized until the transfer is complete. This principle ensures that businesses only recognize revenue when they have actually earned it, which helps to provide a more accurate picture of their financial situation.

Is Cash Flow same as Realization Principle?

These methods can significantly impact financial reporting and when income is recognized on a company’s financial statements. It is important to note time of sale recognition is not commonly applicable in today’s world of accounting in accordance with US GAAP. US GAAP dictates that revenue is recognized when earned, not when cash is received.

You may have noticed that this principle has a close relation with the accrual concept of accounting, which states that the revenue is recorded in the accounting period in which it is earned, not in which it is received in cash. The revenue recognition principle of accounting (also known as the realization concept) guides us when to recognize revenue a 2021 update on tax and education credits in accounting records. According to this concept, revenue should not be recognized by an entity until it is (i) earned and (ii) realized or realizable. Before exploring the concept further through examples, we would briefly explain these two conditions (i.e., earned and realized or realizable) imposed by the revenue recognition principle.

This principle helps public and private companies align their accounting practices with the revenue recognition principle to achieve accurate financial reporting. The Realization Principle is a fundamental accounting principle that outlines when revenue should be recognized in the financial statements. Realization accounting plays a crucial role in financial reporting, ensuring that revenues and expenses are recorded only when they are earned or incurred. This method provides a more accurate reflection of a company’s financial health, which is essential for stakeholders making informed decisions. The company expects to receivepayment on accounts receivable within the company’s operatingperiod (less than a year).

Bir Yorum Yazın