Incorporation and licensing are essential aspects of launching a Forex brokerage firm. The cost of these processes can vary greatly depending on the jurisdiction and type of licence required. Some regulators may require a certain amount of regulatory capital, ranging from $100,000 to over £750,000. With an efficiently structured forex turnkey solution turnkey system, setting up your brokerage can be speeded up considerably, taking mere days instead of the drawn-out months spent crafting a custom platform, getting necessary regulations and securing partnerships. Investingintheweb.com does not provide any offer or solicitation to buy or sell any investment products, nor does it constitute an offer to provide investment advisory services.

Introduction to the Turnkey Pricing Calculator

This platform should include a trading platform core, as well as market data, a CRM system and a client portal.Consider the scalability of your app, its availability on mobile devices, and how you can integrate it with other service providers. Look for a turnkey solution that offers advanced reporting and analytics tools to help you track key performance indicators, monitor trader activity, and make data-driven decisions. The turnkey pricing calculator boasts a range of features tailored to meet the diverse needs of forex entrepreneurs. From customizable parameters to detailed https://www.xcritical.com/ cost breakdowns, the calculator offers unparalleled flexibility and transparency. Real-time estimates ensure that you’re always up-to-date with the latest market trends, allowing you to make informed decisions with confidence.

What Is Included in a Turnkey Forex Solution?

However, the monthly fees vary depending on the services requested and the level of customization needed to offer the desired services to clients. A Forex turnkey solution represents a pre-assembled Forex brokerage business package. It encompasses essential technology, regulatory compliance, infrastructure, and back-office services to expedite the launch of new FX brokerages, ensuring rapid profitability.

For more information on sublicensing as part of the solution, contact our consultant

Whether you’re a seasoned trader or a newcomer, understanding these solutions can help you make informed decisions. In the fast-paced world of foreign exchange (forex) trading, having the right broker can make all the difference. Large brokerages with more clients need more time to manage their portfolios, LXSuite takes care of the technology so that they can take care of what really matters. We give you everything from a trading platform to payment solution intros, as well as personal counseling and advice on building your dream brokerage.

Meet the TickTrader Trading Platform users

The TickTrader Trading Platform is a multi-functional foundation for a robust brokerage or any other type of trading business. Manage FX and digital assets transactions within a flexible setup scheme for different trading conditions. The product represents an ultimate all-in-one solution if you need reliable brokerage trading platform software or a cross-asset platform launching pad. That’s why we created LXSuite, a turnkey solution that is way more than just a complete back-office software. It is a whole new technological approach that includes fx liquidity providers, educational services, and even lead generation. Turnkey Forex software helps take the company to the next level in advertising its brand, ultimately increasing the client base.

All the necessary elements required to run a prosperous brokerage are embedded within these solutions. With a turnkey solution, you not only save time and resources but also get to experience state-of-the-art technology and focus on the future of your company. On the other hand, opting for a white-label solution significantly reduces these costs. White-label solutions offer pre-built and customisable platforms, reducing the setup time and cost significantly. The price for white-label solutions can range from $4,000 to $8,000 per month, also excluding manpower costs.

Use these to expand your reach to new markets and tap into a global customer base that just keeps growing. The best location for opening a Forex brokerage depends on the specific needs and goals of the company. The United States and Switzerland offer prestigious licences, while Australia and Great Britain have less stringent requirements. SmartStart also includes Leverate’s CRM system, which is tailored to the needs of brokers and provides top-level security.

The integration of TWS into white labeling allows Forex brokers to offer their clients a well-established and trusted trading platform with a wide range of currency pairs. IBKR offers a vast selection of over 100 currency pairs for trading, including major pairs like EUR/USD, USD/JPY, and GBP/USD, as well as minor and exotic pairs. Additionally, traders can access Forex options through the TWS platform, allowing them to trade options on currency pairs. The setup time can vary depending on the provider and the specific requirements of the brokerage. Generally, it can take a few weeks to a few months to fully establish and launch a new brokerage using a forex turnkey solution.

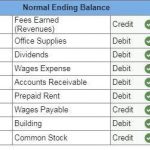

Average distribution of sources of income and costs in the financial plan of brokerage company. This is an approximate cost and revenue structure of a brokerage company that can vary depending on business model, regulation, investments and markets. Determine your market by considering things like the initial cost of capital, marketing strategy, required software, and incorporation procedures.Decide which asset classes to offer and make plans for your future expansion.Select a trading model. A-Books, B-Books, and Hybrids all have different risk levels and potential profits. It involves building a brokerage firm from scratch, which gives you complete control.You will need to create a business plan, select asset classes and choose trade processing methods.

Furthermore, turnkey solutions extend support to areas such as marketing, website development, client relationships, payments, budgeting, and more. In addition to the features mentioned earlier, Soft-FX’s Forex Broker Turnkey solution provides additional benefits that can aid in the successful launch of your brokerage business. The solution delivery and installation process can be completed within a quick time frame of just 2 weeks. Additionally, you can employ a hybrid business model that combines A-Booking and B-Booking to maximize the profit potential of your brokerage.

- With our turnkey pricing calculator, you can navigate the complexities of cost estimation with confidence.

- Additionally, they offer clients several benefits, including $0 volume commission on OTC instruments, low effective spreads, no requotes, and deep liquidity on FX.

- However, navigating through these complexities can be daunting, especially for those new to the industry.

- The package also includes traffic and lead solutions to help drive traffic to the broker’s website and attract potential clients.

- Incorporation and licensing are essential aspects of launching a Forex brokerage firm.

- Furthermore, turnkey solutions extend support to areas such as marketing, website development, client relationships, payments, budgeting, and more.

Scalability is a crucial aspect to consider when selecting a platform to ensure long-term success. It should have the ability to handle high trade volumes and offer customisable options for branding and adding new trading instruments. Opting for a turnkey brokerage, however, drastically cuts these overhead costs.

Our platform and utilities offer access to advanced tools, solid reputable platforms, state-of-the-art customer relationship management, detailed analytics, customer support experts, IB management, IT support, and educational services. Price is one of the most important considerations when selecting WL solutions to launch a Forex brokerage firm. It might be difficult for newbies and even seasoned Forex pros to identify the best alternative because so many businesses are now offering White Label solutions. Based on the trading platform’s capabilities, each White Label supplier has a different pricing structure.

In addition to Forex, X Open Hub provides deep institutional liquidity on 5,000+ global instruments, including indices, commodities, shares, ETFs, and crypto. If a trader is successful, he can consider investments as a diversification of strategies i.e. he has one working strategy and allocates 20-30% of his capital to other traders who can make money. It is also very important to promote the creation of investment portfolios from several signal providers. The role of investor is just to set a risk limit and from time to time monitor the performance of his account. We guarantee low-latency execution through our strategic presence in key financial centers, coupled with a seamless operational setup for rapid FIX API implementation insures swift FIX API Implementation. A carefully designed back-office Forex broker software dedicated to maintaining a healthy trading system.

Using a white label Forex broker can offer many benefits, regardless of which business model you choose. It can help you save valuable time and resources while enabling you to concentrate on building your brand and delivering top-notch customer service. Let’s look at some of the pros and cons of working with a white label Forex broker. Both white-label and turnkey solutions offer valuable pathways to launch an FX brokerage. Open forex broker is a global forex technology provider that is known to offer a delightful experience to its customers. Choose a trading platform that is turnkey from a reliable provider, like Leverate.

This comprehensive solution provides the necessary tools for a Forex brokerage with a reliable software foundation, multi-layered liquidity, robust trading platform, and a convenient back office. The solution includes over 30 technical connectors to major FX liquidity providers, advanced analytics modules, KYC/AML services, and integration with 60+ fiat payment systems. The trading platform has advanced features, including algorithmic trading capabilities, multilingual trading terminals, and advanced trading orders to satisfy even the most demanding clients. Additionally, Soft-FX provides full support throughout the solution implementation process. A typical forex turnkey solution includes a trading platform, access to liquidity providers, regulatory compliance support, risk management tools, customer support services, and marketing and CRM tools.

With Quadcode, you can add a personal touch to your traderoom, choosing a logo, color scheme, and trading tools to make your brand stand out. The white branding fee for IBKR is not disclosed and can vary depending on the level of customization needed and the broker’s specific requirements. To obtain an accurate quote, it is necessary to contact IBKR directly and discuss the requirements. The application review process takes approximately 2-3 weeks, and initial funding of $10,000 must be deposited into the account, which will be applied towards the first five months of commissions. Your inactive clients are probably the most underestimated asset of your company. Do everything possible to highlight good traders and make the selection of a signal provider a simple enough process even for beginners.

Technical analysis is one of the core elements of success in the financial markets. Various indicators, oscillators and tools can help traders identify the trend direction and choose the right moment for opening and closing a position. Has been the main tool that helps FXOpen traders make deposits and withdrawals to trading accounts since 2014. Was born back in 2010 and was designed to expand the opportunities of the platform where FXOpen customers managed their trading. It’s now a versatile, multifunctional product used to satisfy the existing and emerging needs of hundreds of thousands FXOpen traders. The decision rests on a careful evaluation of the pros and cons of each model.

Two prominent approaches are the white label model and the Forex turnkey solution. This article will explore the distinctions between these two methods and their advantages to help you make an informed choice that aligns with your objectives. The journey of launching your own online brokerage is an exhilarating and potentially lucrative endeavor. We are a premium broker solutions provider, dedicated to delivering a wide array of innovative solutions and services that enable Forex brokers and financial institutions to minimize risk and maximize growth. Choose a business plan (IB, White-label or from scratch), define your target market, incorporate and register, choose a trading platform, add unique features to differentiate yourself, hire a team and plan meticulously to ensure a successful launch. Over the years we have gained immense experience and created valuable connections with numerous payment service providers from all across the globe.

Son Yorumlar